Last updated: 28th November 2025

Why Mass-Market Portals Fail €3M+ Buyers

Searching for luxury property in Andorra above €3 million presents a distinct challenge that mass-market portals can’t adequately address. While these platforms display hundreds of listings, the genuine ultra-premium segment—properties offering architectural distinction, prime Pyrenean locations, and the infrastructure sophisticated buyers require—represents fewer than 5% of available inventory.

This creates a frustrating reality: buyers spend more time filtering unsuitable options than evaluating properties worth serious consideration.

Contents

- What makes €3M+ Andorra properties fundamentally different?

- Why do mass-market portals waste sophisticated buyers’ time?

- What do serious UHNWI buyers actually need from property platforms?

- How does curation solve the luxury property search problem?

- What criteria should buyers use to evaluate property platforms?

- How does Black Privé’s model differ from aggregators?

What Makes €3M+ Andorra Properties Fundamentally Different?

The €3 million price point in Andorra represents a fundamental market inflection. Below this level, properties vary widely in quality, location desirability, and finish standards. Above €3 million, expectations crystallize around non-negotiables:

Property standards:

- Exceptional architecture (not standard developer templates)

- Privacy infrastructure (gated access, security systems, discrete positioning)

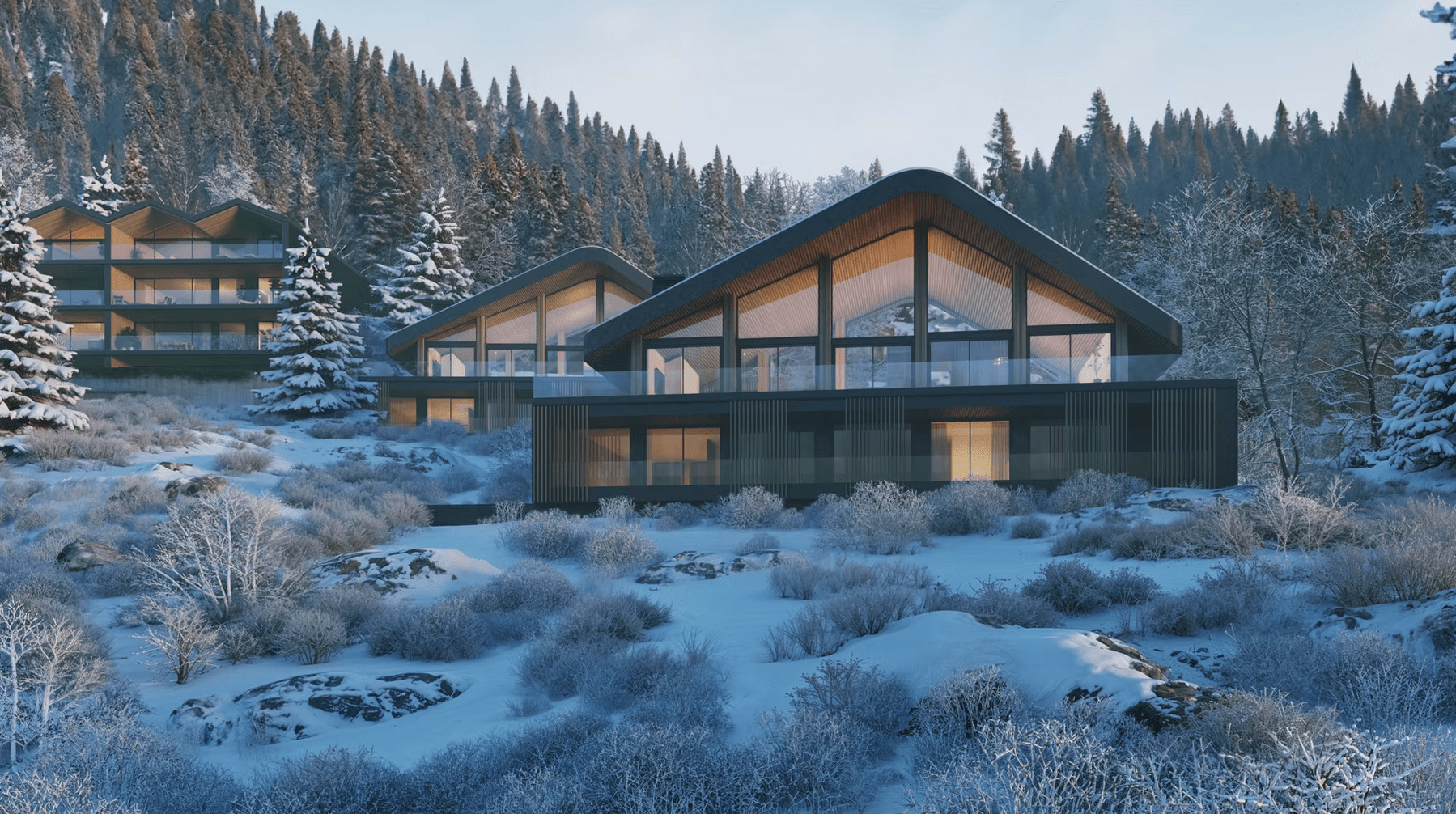

- Premium locations (Ordino mountain estates, Escaldes-Engordany penthouses, ski-access chalets)

- No-compromise finishes (Miele/Gaggenau kitchens, spa-grade bathrooms, climate control)

- Zero immediate investment required (move-in ready, not renovation projects)

Lifestyle infrastructure:

- International schools within 15 minutes

- Helicopter access to Barcelona/Toulouse

- World-class skiing (Grandvalira, Vallnord)

- Private banking relationships

- Michelin-standard dining

Investment framework:

- Tax optimization structures (10% maximum income tax, 0% wealth tax)

- Residency pathway integration (passive or active residence options)

- Asset protection considerations (EU-compliant privacy, stable jurisdiction)

- Multi-generational wealth planning (0% inheritance tax)

Properties below €3M might offer some of these elements. Properties above €3M deliver all of them—or they don’t transact.

Why Do Mass-Market Portals Waste Sophisticated Buyers’ Time?

Table 1: Mass-Market Portal Limitations for €3M+ Searches

| Issue | Impact on UHNWI Buyers | Time Wasted |

|---|---|---|

| No minimum threshold | €400K apartments appear alongside €4M estates | 2-3 hours filtering per search session |

| Volume over curation | 500+ listings, 95% irrelevant | Entire weekends lost to unsuitable viewings |

| Generic agent aggregation | Inquiries distributed to whoever responds first | Multiple calls from unqualified agents |

| “Price on Request” opacity | Can’t assess market positioning | Wastes time on overpriced properties |

| Mobile-first interface | Designed for casual browsing, not serious analysis | Desktop research tools inadequate |

| Language barriers | Catalan/Spanish only interfaces | International buyers face friction |

| No agency vetting | All licensed agents accepted equally | No quality assurance on service standards |

Mass-market portals aggregate all price points without meaningful curation. This approach works efficiently for mid-market transactions where volume compensates for lack of selection. At the €3M+ level, it wastes the most valuable resource sophisticated buyers possess: time.

A typical €3M+ buyer scenario on mass-market portals:

- Search “Andorra luxury property” → 487 results

- Filter “€3M+” → 73 properties (many incorrectly priced or aspirational)

- Read 73 descriptions → 12 merit consideration

- Submit 12 inquiries → 8 agents respond (quality varies dramatically)

- Coordinate viewings → 3 properties actually match requirements

- Total time invested: 15-20 hours before seeing first suitable property

What Do Serious UHNWI Buyers Actually Need from Property Platforms?

High-net-worth property searches operate differently from conventional residential transactions. Understanding these differences clarifies why curated platforms serve this market segment properly:

Curated selection over volume: Buyers at this level don’t browse hundreds of options—they evaluate 8-12 pre-qualified properties meeting specific, non-negotiable criteria. The research phase occurs from home offices on desktop systems with dual monitors for comparative analysis, not mobile devices during commutes.

Transparent pricing: “Price on Request” conceals market reality and suggests either overpricing or agents testing buyer qualification before revealing information. Sophisticated buyers expect straightforward pricing enabling efficient market analysis and portfolio decision-making.

Verified specialist access: Direct contact with agencies proven to transact consistently at €3M+, not aggregated contact forms distributing inquiries to whichever agent responds first. Buyers require confidence that whoever handles their inquiry understands UHNWI-specific requirements (tax structures, privacy protocols, international transfers).

Extended decision timelines: €3M+ acquisitions involve 12-18 month research and evaluation cycles. Buyers need platforms supporting this timeline with:

- Saved search functionality tracking new inventory

- Market intelligence updates (pricing trends, regulatory changes)

- Agency performance history (completion rates, client references)

- Tax and residency pathway guidance

International language standards: While Catalan remains Andorra’s official language, the luxury property market functions in English, attracting buyers from UK, Scandinavia, Germany, Switzerland, and beyond. Platforms operating solely in local languages create unnecessary friction for international transactions representing 70%+ of €3M+ market volume.

Desktop-first analysis tools: Serious buyers need:

- High-resolution photography (40+ images per property)

- Detailed floor plans with measurements

- Location intelligence (schools, airports, ski lifts, banking)

- Comparative market data

- Tax implication calculators

- Multiple property comparison views

Mobile interfaces prioritize casual browsing over analytical depth—inappropriate for decisions involving €3M-€10M capital allocation.

How Does Curation Solve the Luxury Property Search Problem?

Recognizing these dynamics, a fundamentally different model has emerged in Andorra’s luxury segment. Rather than aggregating maximum inventory, curated platforms establish minimum thresholds—€3 million+—that automatically filter the market to properties meeting genuine luxury standards.

Selective agency partnerships: Curated platforms limit listings per partner agency (typically 3-5 properties maximum), ensuring each listing represents the finest offerings rather than volume-driven inventory. Partner agencies undergo selection processes verifying:

- Consistent €3M+ transaction history (minimum 5 sales past 3 years)

- MRICS, NAR, or AGIA professional credentials

- Completion rate above 80% (offer acceptance to successful close)

- Client references from UHNWI buyers

- English language capability (business fluency minimum)

Quality over quantity: A curated platform showing 25 exceptional properties serves buyers better than an aggregator displaying 500 mixed-quality listings. The mathematics are simple:

- 25 curated properties × 2 hours evaluation per property = 50 hours well invested

- 500 uncurated listings × 5 minutes filtering = 42 hours wasted before evaluation begins

Transparent commission structures: Curated platforms disclose how agencies compensate (typically 3-5% seller-paid in Andorra), eliminating conflicts where platforms profit from steering buyers to highest-commission listings regardless of suitability.

Market intelligence integration: Beyond property listings, curated platforms provide:

- Parish-by-parish investment analysis

- Tax optimization frameworks

- Residency requirement guidance

- Agency comparison data

- Market trend reporting

This intelligence helps buyers understand why they’re considering Andorra (tax efficiency, lifestyle quality, political stability) alongside what they’re buying (specific properties).

What Criteria Should Buyers Use to Evaluate Property Platforms?

Table 2: Property Platform Evaluation Framework for €3M+ Buyers

| Criterion | Curated Platform | Mass-Market Aggregator |

|---|---|---|

| Minimum price threshold | €3M+ enforced | No threshold (€200K-€20M mixed) |

| Agency identification | Each listing shows specific agency | Often obscured behind inquiry forms |

| Pricing transparency | All prices displayed upfront | 40%+ “Price on Request” |

| Interface priority | Desktop analysis tools | Mobile-first casual browsing |

| Agency selection | Verified €3M+ transaction history | Any licensed agent accepted |

| Listing limit per agency | 3-5 properties maximum | Unlimited inventory |

| Language | English primary | Often Catalan/Spanish only |

| Market intelligence | Integrated tax, residency, market data | Property listings only |

| Inquiry routing | Direct to specialist agency | Distributed to multiple agents |

| Commission disclosure | Transparent structure | Often undisclosed |

When assessing platforms for €3M+ Andorra property search, evaluate:

- Does the platform establish minimum price thresholds eliminating mid-market noise?

- Can you identify specific agencies behind each listing, or does the platform obscure this information?

- Are prices displayed transparently, or hidden behind inquiry forms requiring qualification calls?

- Does the interface prioritize detailed property information and high-resolution documentation, or mobile-optimized browsing?

- Are partner agencies selected based on ultra-premium transaction history, or does the platform accept any licensed agent?

- Does the platform limit listings per agency to ensure quality curation?

- Is English the primary language, or do international buyers face translation barriers?

- Does the platform provide integrated market intelligence (tax frameworks, residency pathways), or just property listings?

Platforms failing 5+ of these criteria serve mid-market buyers better than UHNWI purchasers allocating €3M-€10M to Andorran property.

How Does Black Privé’s Model Differ from Aggregators?

Black Privé represents the curated approach specifically designed for the €3M+ luxury segment:

€3 million minimum threshold: Every property meets ultra-premium standards. No time wasted filtering €400K apartments or €1.2M mid-market offerings.

Elite specialist network: Partner agencies vetted for proven €3M+ transaction capability. Sotheby’s International Realty, Andbanc Wealth Management, Montagnenca—established names with decade+ Andorran market expertise.

Transparent pricing: No “Price on Request” opacity. Every listing shows exact pricing enabling efficient market analysis and portfolio planning.

Direct agency access: Contact forms route directly to listing agency, not distributed to multiple agents creating inquiry chaos and privacy concerns.

Integrated intelligence: Market reports, tax optimization frameworks, residency pathway guidance, agency performance data—comprehensive context surrounding property decisions.

Selective curation: Partner agencies limited to 3-5 premium listings maximum. This ensures only exceptional properties appear, maintaining platform integrity and buyer trust.

For those seeking luxury property in Andorra with the efficiency and discretion that significant acquisitions demand, understanding these distinctions determines whether your search consumes months of filtering or focuses immediately on properties meriting serious consideration.

About the Author

Alexander Thornbury MRICS analyzes European luxury property markets for UHNWI buyers and family offices. With 15 years at Knight Frank International and Savills, he specializes in cross-border transactions and tax-efficient property structuring. Alexander holds MRICS accreditation and contributes market intelligence to Black Privé’s research library.

Related Articles

- The Perfect Retreat for Luxury Property Buyers in Andorra →

- Pyrenean Luxury Meets Financial Sophistication: Andorra’s Investment Case →

- Andorra: A Haven for Families Seeking Quality Education and Alpine Lifestyle →

For exclusive access to Andorra’s most exceptional properties above €3M, visit blackprive.com or contact andorra@blackprive.com